Performance

We believe our longevity coupled with our long-term track record speaks to the quality of our work.

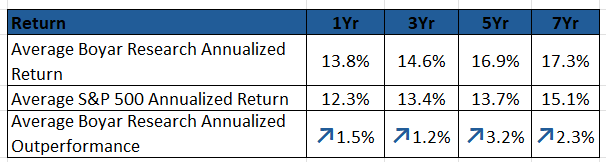

Performance of Stocks Profiled by Boyar Research's All-Cap Publication Asset Analysis Focus

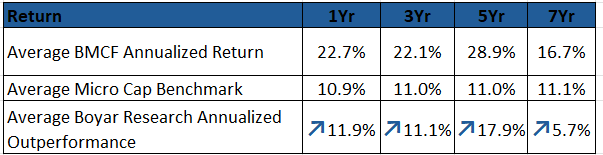

Performance of Stocks Profiled by Boyar's Micro Cap Focus

Performance Statistics

Asset Analysis Focus

- Approximately 52% of companies featured outperformed on a one year basis.

- The average outperformance of "winners" was 24% , 21%, 23%, and 21% for 1, 3, 5 and 7-year time horizons.

- Annualized outperformance relative to the benchmark is highest over 5 years (4.6% outperformance), demonstrating our long-term oriented outlook.

Boyar's Micro Cap Focus

- ~1/2 of ideas profiled in Boyar’s Micro Cap Focus were acquired.

- 52% of all the ideas profiled outperformed the index since inception.

- The average outperformance (annualized) among stocks featured was 48%, 32%, 41%, and 21% on a 1, 3, 5, and 7 year basis.